In this project I used the Kaggle Customer Churn data to determine whether the customer will churn (leave the company) or not. I split the kaggle training data into train and test (80%/20%) and fitted the models using train data and evaluated model results in test data.

I used mainly the semi automatic learning module pycaret for this project.

I also used usual boosting modules (xgboost,lightgbm,catboost) and regular

sklearn models.

In real life the cost of misclassifying leaving customer and not-leaving customer is different. In this project I defined the PROFIT metric as following:

profit = +$400 for TP : incentivize the customer to stay, and sign a new contract.

profit = 0 for TN : nothing is lost

profit = -$100 for FP : marketing and effort used to try to retain the user

profit = -$200 for FN : revenue lost from losing a customer

TP = true positive

FP = false positive

FN = false negative

After testing various models with extensive feature engineering, I found that the xgboost algorithm gave the best profit.

TotalCharges with 0.SeniorCitizen + Dependents.TotalCharges per Contract.yeo-johnson transformers instead of standard scaling since the numerical features were not normal. Accuracy Precision Recall F1-score AUC

LR 0.4450 0.3075 0.8717 0.4547 0.5812

Predicted

Predicted-noChurn Predicted-Churn 0 1

Original no-Churn [[301 734] TN FP

Original Churn [ 48 326]] FN TP

Let's make following assumptions

TP = +$400

TN = 0

FP = -$100

FN = -$200

profit = tn*0 + fp*(-100) + fn*(-200) + tp*400

= 400*tp - 200*fn - 100*fp

tn,fp,fn,tp = confusion_matrix(y_true,y_pred)

LAST+ 2ndrow 1strow

profit = 400*326 - 200*48 - 100*734

= 47400

============================ LogisticRegressoinCV======================

Accuracy Precision Recall F1-score AUC

LRCV 0.7367 0.5024 0.8396 0.6286 0.7695

[[724 311]

[ 60 314]]

profit = 82,500

--------------------------------- xgboost -------------------------------

Accuracy Precision Recall F1-score AUC

xgboost 0.7097 0.4749 0.8850 0.6181 0.7657

[[669 366]

[ 43 331]]

Profit = $87,200

--------------------------------- lightgbm ------------------------------

Accuracy Precision Recall F1-score AUC profit

lgb+hyperband 0.7069 0.4651 0.6952 0.5573 0.7031 $51,300

lgb+hyperopt 0.64088 0.419903 0.925134 0.577629 0.731649 $85,000

I did a lot of hyperparameter tuning of lgb with hyperopt for multiple days.

I got following results

5-foldCV TestProfit

params_lgb1 68,900 83,000

params_lgb2 69,340 82,700

params_lgb3 69,420 87,900 ** This has largest test profit, but less cv

params_lgb4 69,480 85,000 ** We never see the test data, we only see train data

So, we must choose the parameters with highest cross validation score.

Here params_lgb4 gives higher profit than params3, this means it is possible to

get higher score but we need to get it along with higher validation score.

We can try about 10k hyperopt trials but so far I have tried only upto 5k trials.

Note about hyperopt:

When I dumped the hyperopt trial to a file and load again and used in hyperopt

then, it gave me the same results in microseconds even if I run further thousands

of trials. This means using old trials does not work. Always use new trials but

we can pickle dump it so that we can see the trials history.

--------------------------------- catboost -------------------------------

Accuracy Precision Recall F1-score AUC

catboost+optuna 0.6955 0.4618 0.8877 0.6075 0.7569

[[648 387]

[ 42 332]]

profit = $85,700

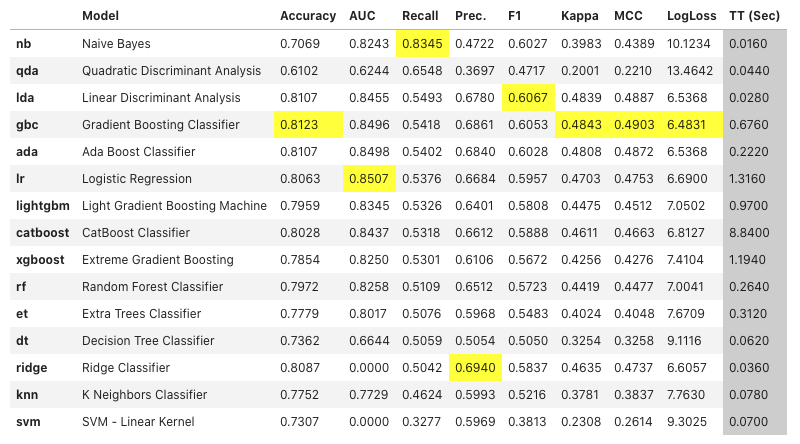

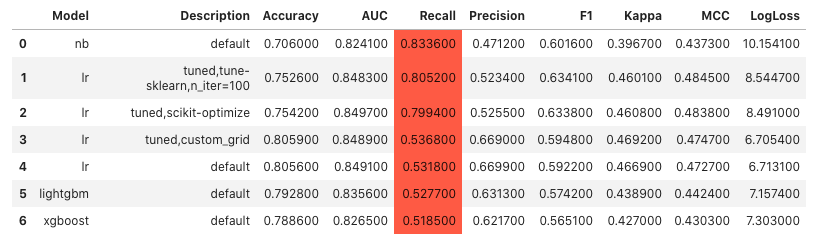

MCC and LogLoss.tune-sklearn algorithm to tune logistic regression.

Pycaret Logistic Regression

==============================================================

Accuracy Precision Recall F1-score AUC

pycaret_lr 0.7509 0.5199 0.8021 0.6309 0.7673

[[758 277]

[ 74 300]]

profit = 400*300 - 200*74 - 100*277

= 77,500

Pycaret Naive Bayes

==============================================================

Accuracy Precision Recall F1-score AUC

pycaret_nb 0.7296 0.4943 0.8102 0.6140 0.7553

[[725 310]

[ 71 303]]

profit = 400*303 - 200*71 - 100*310

= 76,000

Pycaret Xgboost (Takes long time, more than 1 hr)

===============================================================

Accuracy Precision Recall F1-score AUC

pycaret_xgboost 0.7601 0.5342 0.7513 0.6244 0.7573

[[790 245]

[ 93 281]]

profit = 400*281 - 200*93 - 100*245

= 69,300

Pycaret LDA (Takes medium time, 5 minutes)

================================================================

- Used polynomial features and fix imbalanced data.

Accuracy Precision Recall F1-score AUC

pycaret_lda 0.7062 0.4704 0.8503 0.6057 0.7522

[[677 358]

[ 56 318]]

profit = 400*318 - 200*56 - 100*358

= 80,200

Accuracy Precision Recall F1-score AUC

evalml 0.7977 0.6369 0.5535 0.5923 0.7197

[[917 118]

[167 207]]

profit = 400*207 - 200*167 - 100*118

= 37,600

customerID and gender.TotalCharges with 0.class_weight parameter to deal with imbalanced data.GridSearchCVModel parameters

{'activation': 'sigmoid',

'batch_size': 128,

'epochs': 30,

'n_feats': 43,

'units': (45, 30, 15)}

NOTE: The result changes each time even if I set SEED for everything.

Accuracy Precision Recall F1-score AUC

keras 0.6849 0.4422 0.7166 0.5469 0.6950

[[697 338]

[106 268]]

profit = 400*268 - 200*106 - 100*338

= 52,200

This is a imbalanced binary classification.

The useful metrics are F2-score and Recall.

AUC is useful only when dataset is balanced.

F1 is useful when precision and recall is equally important.

Here I defined a custom metric "profit" based on confusion matrix elements.

- Logistic regression cv algorithm gave me the best profit.

- I used custom feature engineering of the data.

- SMOTE oversampling gave worse result than no resampling.

(note: I have used class_weight='balanced')

- Elasticnet penalty gave worse result than l2 penalty.

- Make custom loss scorer instead of default scoring such as f1,roc_auc,recall.

Profit = 400*TP - 200*FN - 100*FP

TP = +$400 ==> incentivize the customer to stay, and sign a new contract.

TN = 0

FP = -$100 ==> marketing and effort used to try to retain the user

FN = -$200 ==> revenue lost from losing a customer

Some Notes about comparing models:

- We should never directly compare test dataset, we may simply overfit the test

data. It's like training test data and overfitting by best hyperparams.

- We should compare validation splits and validation splits must have very small

standard deviation, then, after we get hyperparams from training/validation,

we use these hyperparams to see how it does in test.

We can not change hyperparameter based on test results, but we can change

based on validation results.

- Here I have reported the test profit, but for model comparison we can report

cross-validation profit.

Accuracy Precision Recall F1-score AUC Profit

-------------------------------------------------------------------------------

xgboost 0.7097 0.4749 0.8850 0.6181 0.7657 $87,200

catboost+optuna 0.6955 0.4618 0.8877 0.6075 0.7569 $85,700

lgb+hyperopt 0.64088 0.419903 0.925134 0.577629 0.731649 $85,000

LRCV 0.7367 0.5024 0.8396 0.6286 0.7695 $82,500

pycaret_lda 0.7062 0.4704 0.8503 0.6057 0.752200 $80,200

pycaret_lr 0.750887 0.519931 0.802139 0.630915 0.767253 $77,500

pycaret_nb 0.729595 0.494290 0.810160 0.613982 0.755322 $76,000

pycaret_xgboost 0.760114 0.534221 0.751337 0.624444 0.757311 $69,300

keras 0.684883 0.442244 0.716578 0.546939 0.695004 $52,200

lgb+hyperband 0.7069 0.4651 0.6952 0.5573 0.7031 $51,300

LR 0.444996 0.307547 0.871658 0.454672 0.581240 $47,400

evalml 0.7977 0.6369 0.5535 0.5923 0.719700 $37,600

lgb+optuna 0.7473 0.5262 0.4840 0.5042 0.6632 $17,500